Australian debt clock: Young Australians credit crisis, a life in debt

We are seeing a dramatic 20% increase in the tens of thousands bad credit inquiries we see every year. The proportion of these that are caustic, well beyond dangerous has grown a further 30% . This means that a great deal of people need urgent finance who may never be able to get it, or find themselves in an even more harmful downwards debt spiral.

Enough is enough, bad credit in Australia is increasing and we need to do more to stop the rot. The finance industry is seeing more impaired credit daily than ever before, the Australian debt clock is scarily ticking up at a rapid rate. In follow-up among these alarming trends, we’ve completed research to further explore this crisis amongst young Australians.

We recently conducted a study of over 1,000 people to assess the state of bad debt in 18-24 year olds in Australia. The results paint a worrying picture of a high proportion of young Australians oblivious to the dangers and ongoing consequences of poor debt management.

We will be taking a closer look at the results, reviewing how the insights fit against a wider backdrop of important issues and begin the conversation about what can be done to help support and improve these worrying trends for our young Australians.

The Australian debt clock is ticking it’s not pretty

At a time when Australians are consuming more debt than ever, we are seeing record high balances on credit and charge cards ($52 Billion, RBA Data, C1 Credit and Charge Card Statistics, Dec 15). Coupled with increased household debt to income, some of the most expensive property and living costs globally, an aging population and reduced wage growth, there has never been more important to time to ensure we are doing all we can to manage dangerous levels of debt.

Based on our expertise and insights in finance and debt lending we undertook to examine these issues more carefully to see how young Australians are faring, the results are alarming.

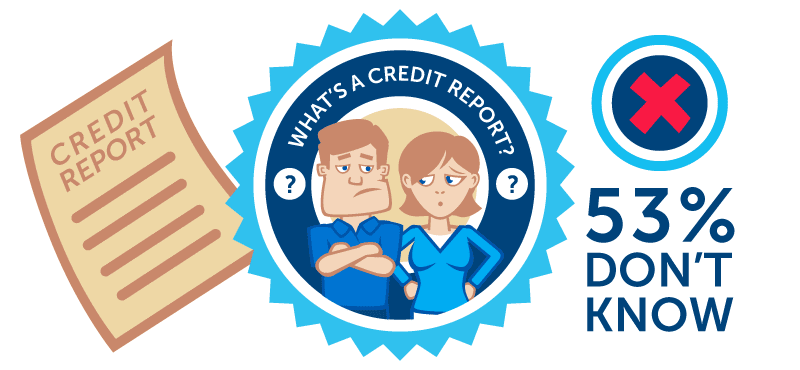

Source: Positive Lending Solutions, Bad Credit Survey January 2016, Q1: Do you know what a credit report is?, n = 1,013, 53% No).

Of considerable concern from the research was that greater than 50% of young Australians aged between 18-24 did not know what a credit report was. In recent years, our credit reporting mechanisms and the financial situations of young Australians have both seen important changes so it’s vital they are well understood.

The Privacy Act changes that came into effect in 2014 meant that licensed credit providers could have a much more comprehensive view of people’s credit profiles. Not only can the success rate of credit applications be viewed, but also whether you had kept up to date with your payments, or defaulted on credit obligations altogether. Further insights from our study showed that six out of ten people (aged 18-24) had signed up for a phone contract , so even at a basic level would people be impacted by their credit behaviour, good or bad, but unfortunately for most, unknowingly.

Widening the scope of this problem an earlier study highlighted that three in every ten people between the ages of 18-29 were in the red, in debt in absolute terms (Co-Op Future Leader Index, May 2015, p.4). Those particularly affecting this group were those living in regional Australia, in Adelaide (which had the next weakest net financial position, and high individual debt of $5K), and female respondents who had a considerably weaker financial position compared to males.

Even with specific reference to these groups it’s clear that more needs to be done to support debt management with younger Australians as again, more than 50% are not even aware if they have a good or bad credit rating. It’s one concern not to be aware of your credit score but certainly another when having to face the harsh realities of it’s impact. More data is collected and reviewed than people probably realise.

Not paying back a minimum credit card balance each month, being a little late on phone bills, or even shopping around for credit can all have an impact. When these events affect the (unknown) credit score, trouble can be far reaching and certainly affects a lot more than just credit. Not being able to get a cell phone contract, difficulty in getting approved for an apartment, or facing hurdles when applying for certain jobs are few examples of the bad credit reality that can come calling. Most people are unaware of how credit reporting laws changed (Mid 2014!), it’s more important than ever to establish safer, long lasting behaviours and much better awareness of these impacts from an earlier age.

Source: Positive Lending Solutions, Bad Credit Survey January 2016, Q1: Do you have and use a personal budget?, n = 1,013, 53% No).

One stark contrast of our survey to the 2015 Young Leaders Index was that 50% of respondents don’t use a personal budget. We’ve all heard it, we know it works, but we’re not all doing it. Having a sensible budget and sticking to it goes a long in avoiding and improving an ongoing debt crisis.

Having this type of budget helps to honestly assess and reduce expenditure, it includes sensibility and realism so it’s not shot after a time of champagne expenses on beer budgets, it’s regularly reviewed, and it includes some of the great basics like having a safety buffer. With all budget related theory this certainly makes sense, it’s just that they theory isn’t making it’s way out onto the playing field.

In 2013 a much more comfortable picture was presented than what we are seeing today. At the time reporting termed 18-29 year old Australians as ‘Generation Sensible’, in 2015 it was extended that this group, was prudent, planned and financially responsible, resulting in good levels of savings with 70% having a clear budget around finances (2015 Leaders Index).

We are either seeing either a growth in those not budgeting or greater inconsistency in the way that young Australians are perceiving the need to have a clear budget and being able to stick with it. With unemployment rising for youth and again against the backdrop of expensive property and lower wages, it’s crucial that budget measures are taken to avoid debt pitfalls and the long term possibility that these behaviours will lead to a lifetime of debt.

The long-term prospects, a lifetime in debt?

From the insights we’ve seen, the use of personal budgeting and the understanding of bad debt at an overall level for young Australians is poor. With a third of this group already in debt the big concern is the amount of debt they will be impacted by across their lifetime. Again even more scary is just how fast Australia's debt clock is increasing.

As highlighted in the 2015 Leaders Index, 87% of respondents aged 15-29 believed that due to the high cost of housing, many of their generation would never own their own home. The biggest worries that supported this were property debt, the cost of raising a family, study debt and being able to have enough money to retire on.

It’s clear that this is an issue for now, but not all of the load needs to be thrown at the younger generation. Families have been shown to be highly influential in not only supporting effective budgeting and financial habits, but also in their ongoing support. The majority of young people turn to ‘the bank of Mum and Dad’ for support in getting a foot on the property ladder. It’s important not to discount the future impact these arrangements may have, especially if our economic environments become more challenging.

The rapid rate of increase in the Australian debt clock does not all reside at home. At a high level, across major lending institutions it’s particularly concerning to view the product mixture and care of service that is being applied to credit based products. The overwhelming supply and volume of options to attain interest bearing credit cards or overdraft facilities pales in comparison to how much caution and advice is provided on how to use these products properly, with less harm. The sales view here clearly seems to be ‘how much can you borrow’ versus ‘what can you afford’, this is dangerous and simply not good enough.

The debt paradox, high awareness, problems persist

With all this considered, an interesting paradox still persists with the concerns of young Australians versus their purchase behaviour. They expressed very high levels of uncomfortability for taking on debt (79%). Despite, this most were willing to take on mortgage debt (75%), and a high proportion (30%) would even buy something they wanted, without considering if they could afford it (Co-Op Future Leader Index, May 2015, p. 10).

What is likely is that young Australians are feeling pressure to ‘get on the property bandwagon’ and that not doing so only delays the inevitable debt commitment, feeling the increased pressure of missing out if they don’t do so. There are many real stories of how this is impacting this generation, despite the lending most believe they will never own their own home, so this is clearly an issue that needs considerable attention and support.

Educational institutions also need to ensure that not only are suitable tools being provided to young Australians to manage these challenges as they leave school, but that they clearly understand the importance of doing so and use them.

It's time to draw a line in the sand, further work in this series

It can’t be denied that more needs to be done to reduce the worry and improve the capability of young Australians in managing debt and their personal finances more effectively. The awareness and importance of managing these issues needs urgent attention, from Young Australians, from educators, from parents, those involved in finance supply and those making policy decisions.

From the alarming insights we’ve seen we’re taking a stand to work with stakeholders and investigate the following as part of this series:

- Highlighting the importance and need for urgency in dealing with bad debt more effectively for Young Australians

- Providing more clarity on what impacts credit scores

- Providing awareness and insight into simple tools that can be used to manage debt and personal budgeting more effectively

- Teaching financial management strategies that empower young Australians to make the right moves

The Australian debt clock is ticking, a credit crisis is here for our Young Australians and it's time to deliver more effective actions to help avoid a lifetime in debt.