How Car Dealers Advertise Car Loans for Very Low Interest Rates

0% Interest: what does it really mean?

' Zero percent interest ’ loans are a type of finance offered by the car manufacturer through a car dealership.’These loans are available for brand new cars, and they usually have a relatively short term.

How can the manufacturer afford to grant a loan without charging any interest? Are they genuinely losing money on the deal?

This type of finance is called ‘sub-venting’. What really happens is that the manufacturer does pay interest to the lender. But they aren’t taking a cut in profits. The dealer covers the difference with an inflated overall price on the new car.

Over the last few years, we have seen a trend by car dealers with promotions on ridiculously low interest rates on their car loans. DO NOT be fooled by these promotions. It is easy to get sucked into these promotions as seeing an interest rate of 1% would get anyone excited. Here are a few tactics these dealers use during these promotions which will see you pay the interest in various ways.

ASK the dealer

With zero percent finance you won’t be able to negotiate the price of the car. However, now that the dealer has you in his showroom, he’s not going to want to lose the sale.

If you like the car, go ahead and ask the dealer how much it would be if you arrange your own finance. it’s also a good idea to search online and compare the average price of the car without a 0% interest offer, so you know if you’d be getting a good deal.

The dealer should be frank with you as the purpose of advertising a 0% car finance offer is to get you into the showroom. If you don’t meet the strict loan criteria attached to the offer, the dealer will find another way to sell you the car you want.

Shop Around

A dealer will try to close the sale the day you first visit the showroom. If you’ve shopped around to find the best deal on finance, you’ll know if you’re being offered a competitive deal. After all, knowledge is a great bargaining tool.

The thing to compare is the total cost of the loan.

Then make sure that you can afford the repayments on your current income, allowing for car running and maintenance costs. Zero percent interest loans often have a shorter loan term, pushing up the monthly repayments.

Make sure that you understand what the terms of the loan are before you agree:

- What are the monthly repayments?

- Do you need a large deposit?

- Is there a large residual or balloon payment at the end of the finance contract?

- What is the loan term?

- Is there a requirement that the car be serviced by the dealer?

- Is there an application fee?

If you have a pre-approved loan, you know how much you can afford to pay, both in monthly repayments, and for the total cost, including any fees and interest, of the loan contract.

If the dealer knows you’ve shopped around, you might suddenly get a better deal than the initial offer.

An independent finance broker can source quotes from a number of lenders with a single credit enquiry, and has access to loan options that might not be publicly advertised. The broker will also be able to advise you on which lenders you can successfully apply to. All of this is done with no obligation if you can find a better deal elsewhere.

Car dealership finance pitfalls to watch for:

To qualify for a Zero Percent car finance loan, you will probably need to have a flawless credit file.

Have a good look at the loan contract. Is it a requirement that the car be serviced by the dealer?

- If this is the case, it’s wise to find out what the servicing costs are in advance.

- Check these against a quote from a reputable RAA approved mechanic or a franchise such as Ultratune or Repco.

- The amount of money that you appear to be saving might be more than recovered by the dealer in inflated maintenance costs.

Question the trade in value of your current vehicle if you are trading in as part of the contract. You may find that your old car is drastically undervalued. You can check the value of your old car to see if you are being offered a fair price.

You might find that you’ll be better off to sell your old car independently.

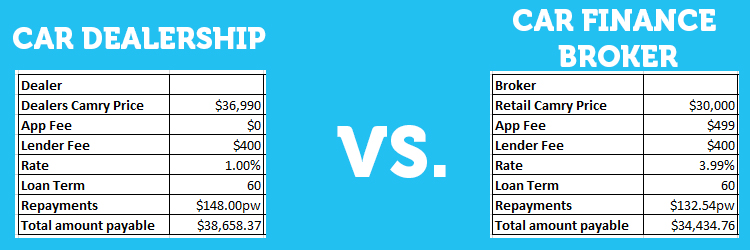

Case Study: Steven's 1% low interest offer from a dealerThe first thing you want to know is, are you getting a good deal? The dealer’s will tell you that we can get you 0% interest rate or 1% interest rate on the finance. But what you should really be looking at is the price of the car. Steven went into an local dealership to buy a new Toyota Camry Atara, the dealer offered him 1% finance. Steven got a quote from the dealer for the vehicle with finance After some consideration Steven called a car finance broker to enquire and compare what they could do for finance The details of this exact case study are below:

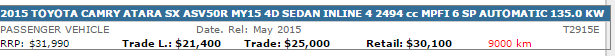

In the above example the vehicle purchase from a dealer has a higher 'sale' price. Below is the Below is the RedBook Retail Value of a Toyota Camry Atara for $30,000:

This is also the retail value of the car, this doesn’t take in consideration the fleet discount a finance broker has access to, which could end up saving you even more. Steven ended up saving a total of $4223.61 using a finance broker for both the finance and to purchase the car Steven's savings equated to a lower repayment of of $61.84 per month |

You don’t get nothing for nothing: So what should you do?

Being well informed is the best way to make sure you get your money’s worth on a new car. One of the easiest ways to compare the finance that’s available is to ask an independent expert. With a quick, free enquiry, you can find out what your financing options are, and what rates, costs and monthly payments to expect on truly cheap car finance.

It’s important to focus on the loan contract as a whole, and not just to compare the car finance rates.

If you’ve spoken to a broker, and you have pre-approval for new car finance you put yourself into a stronger bargaining position. If it turns out that you don’t qualify for a 0% loan, and the dealer offers you a higher interest rate loan, you won’t fall victim to this ‘bait and switch’ technique. You’ll know upfront whether you’re being offered a good deal, or if you already have a better one.

An independent finance broker can advise you on whether you’ve struck a good car finance deal, or they can help you to find a better deal on your ideal new car.

Your broker deals in the car finance market every day, so they know a fair price when they see it. If you’ve been offered a zero percent loan at a dealer, speak to the broker. If you're looking for a car for business, you can get low chattel mortgage interest rates.

Whatever the purpose of your loan is, a car loan broker may be able to negotiate a better price for you, and set you up with the right cheap car finance option.